BIG DATA

Intel's sales took a nosedive in Q2

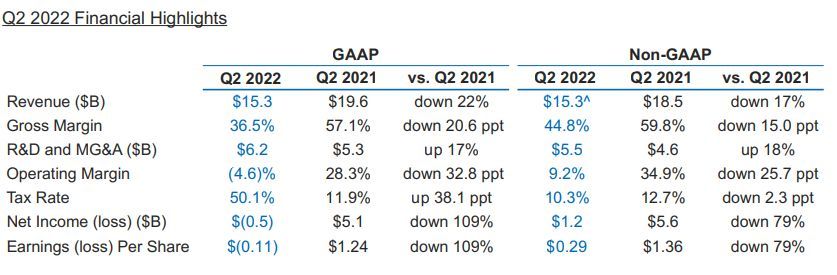

In the second quarter, Intel's revenue was $15.3 billion, down 22% year over year (YoY). The company’s data center group was impacted by continued falling sales, down 16%; Network and Edge Group and Mobileye achieved record quarterly revenue.

It was its biggest sales drop in more than a decade. The company blamed a rapid decline in economic activity for its sagging sales.

Intel's revenue missed consensus on the street by 14%, the company’s largest disappointment since 1999. It ended the quarter with a $454 million net loss, compared with a net income of $5 billion in the year-ago quarter. The gross margin narrowed to 36.5% from 50.4% in the previous quarter.

“This quarter’s results were below the standards we have set for the company and our shareholders. We must and will do better. The sudden and rapid decline in economic activity was the largest driver, but the shortfall also reflects our own execution issues,” said Pat Gelsinger, Intel CEO. “We are being responsive to changing business conditions, working closely with our customers while remaining laser-focused on our strategy and long-term opportunities. We are embracing this challenging environment to accelerate our transformation.”

"We are taking necessary actions to manage through the current environment, including accelerating the deployment of our smart capital strategy, while reiterating our prior full-year adjusted free cash flow guidance and returning gross margins to our target range by the fourth quarter," said David Zinsner, Intel CFO. "We remain fully committed to our business strategy, the long-term financial model communicated at our investor meeting, and a strong and growing dividend."