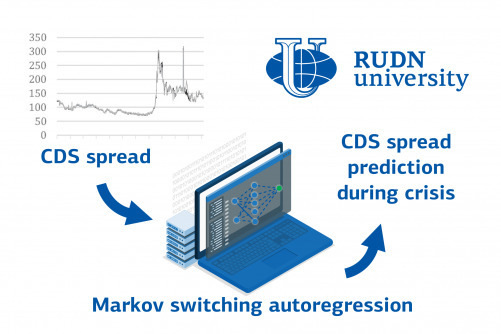

RUDN economists have found the best mathematical method for predicting the price of a credit default swap - a creditors' insurance instrument. Results are published in Expert Systems with Applications.

A credit default swap (CDS) is a kind of insurance for a creditor. Swap can be bought and sold just like regular insurance. It is worth buying it for the one who issued the loan and fears that the debtor will not return it (for example, due to bankruptcy). The seller of the swap assumes the obligation to repay the loan for the debtor if the debtor goes bankrupt. Now CDS has another role. It is bought not only to avoid the risks of bankruptcy of the borrower but to resell at a higher price. CDS has become an independent object in the market, and its price depends on credit risks, so it is necessary to learn how to predict CDS price changes. RUDN economists compared several mathematical approaches and identified the most effective tool.

“The forecasting of systematic patterns is mostly related to predicting the prices of various assets, however, only a few studies forecast credit default swaps. Such forecasting, which has a non-stationary nature, is very difficult because it is chaotic, dynamic, and nonlinear,” said Darko Vukovich, Ph.D., Associate Professor of the Department of Finance and Credit of RUDN University.

Economists took credit default swap price data from 513 leading US companies from 2009 to 2020. In total, RUDN economists tested four methods, including models with machine learning. The data included daily one-year, 4 years, 7 years and 10 years CDS purchase costs. Data from 2009 to 2018 was used to train the model. Then, changing the parameters, the economists obtained three forecasts for each of the four methods - two before March 11, 2020, and one after this date. March 11, 2020, is the day the WHO declared the COVID-19 pandemic. Thus, scientists were able to evaluate how the proposed models work in a crisis.

An autoregressive model with Markov switching (MSA) turned out to be the most relevant for forecasting. Before and after the pandemic, for 1 year, 4 years, 7 years, and 10 years, the MSA forecast turned out to be the most accurate more often than others were. At the same time, in general, for all methods, the COVID crisis reduces the accuracy of the forecast, although only slightly. For example, according to the MSA method for a four-year CDG before the pandemic, the errors were 3.3%, and during the COVID pandemic - 6.4%.

“MSA outperforms all other methods more frequently than the others. The change in relative predictability during COVID-19 is small. We found that the market was less efficient during COVID-19, but there are no big differences in forecasting indicators before and during the pandemic,” said Elena Grigorieva, Ph.D. in Economics, Deputy Dean for Research at RUDN University Faculty of Economics.

How to resolve AdBlock issue?

How to resolve AdBlock issue?